Governance, Risk and Compliance (GRC)?

Learn about the concepts of Governance, Risk and compliance, in short GRC.

- Articles

- Compliance

- What does Governance, Risk and Compliance mean?

Table of Contents

Introduction

When running a business, you are undoubtedly aware that the world is constantly changing and new challenges arise. These can include strategic decisions about how your business should evolve or external demands that emerge unexpectedly.

This is where an understanding of Governance, Risk, and Compliance (GRC) can become a strategic advantage, enhancing your business's sustainability and long-term success.

This article aims to explore the three concepts – Governance, Risk, and Compliance – and illustrate how they can contribute to your business model. Within these three areas, you will find tools that can help address various business challenges and seize new opportunities. For example:

-

An effective governance structure that ensures responsible and transparent management.

-

Conducting thorough risk assessments and implementing risk management strategies.

-

Gaining an overview of legal requirements and ensuring your business complies with them.

You will also find information on how dedicated GRC software can streamline and systematise principles and tools within Governance, Risk, and Compliance.

What Does Governance Mean?

Governance represents a collection of rules, structures, processes, and guidelines that together form the backbone of effective corporate management. It is not merely a management tool for imposing rules from the top but rather a culture of accountability where tasks and responsibilities are integrated at all levels of the organisation – from senior management to employees.

But what does governance actually involve? While it can be challenging to provide a precise definition, governance can generally be described as a system of processes, rules, and guidelines that direct the organisation. This system includes areas such as ethics, risk management, compliance, and administration. Here, you may already find parallels to well-known compliance areas such as ESG, GDPR, CSRD, and NIS2. The goal of governance is to ensure effective decision-making, accountability, control, and appropriate behaviour within the business – requirements that many regulatory frameworks also demand.

Good governance does not emerge on its own, nor is it something you can ensure as an individual. Governance involves establishing clear roles and responsibilities, ensuring transparency, and balancing the diverse interests of stakeholders. It requires collaboration and commitment from all involved – including management, the board of directors, shareholders, and employees.

Governance is also not a project you can check off as complete. It is an ongoing process that must be integrated into daily operations and can evolve, improve, and adapt over time.

The value of a solid governance process cannot be overstated. It applies to businesses of all sizes and across all industries. Good corporate governance creates value, reduces risks, and builds trust in the organisation. Moreover, it contributes to a positive working environment for employees, customers, and suppliers, where everyone understands their roles, responsibilities, and the processes that come into play if something unexpected happens.

What does Risk Mean?

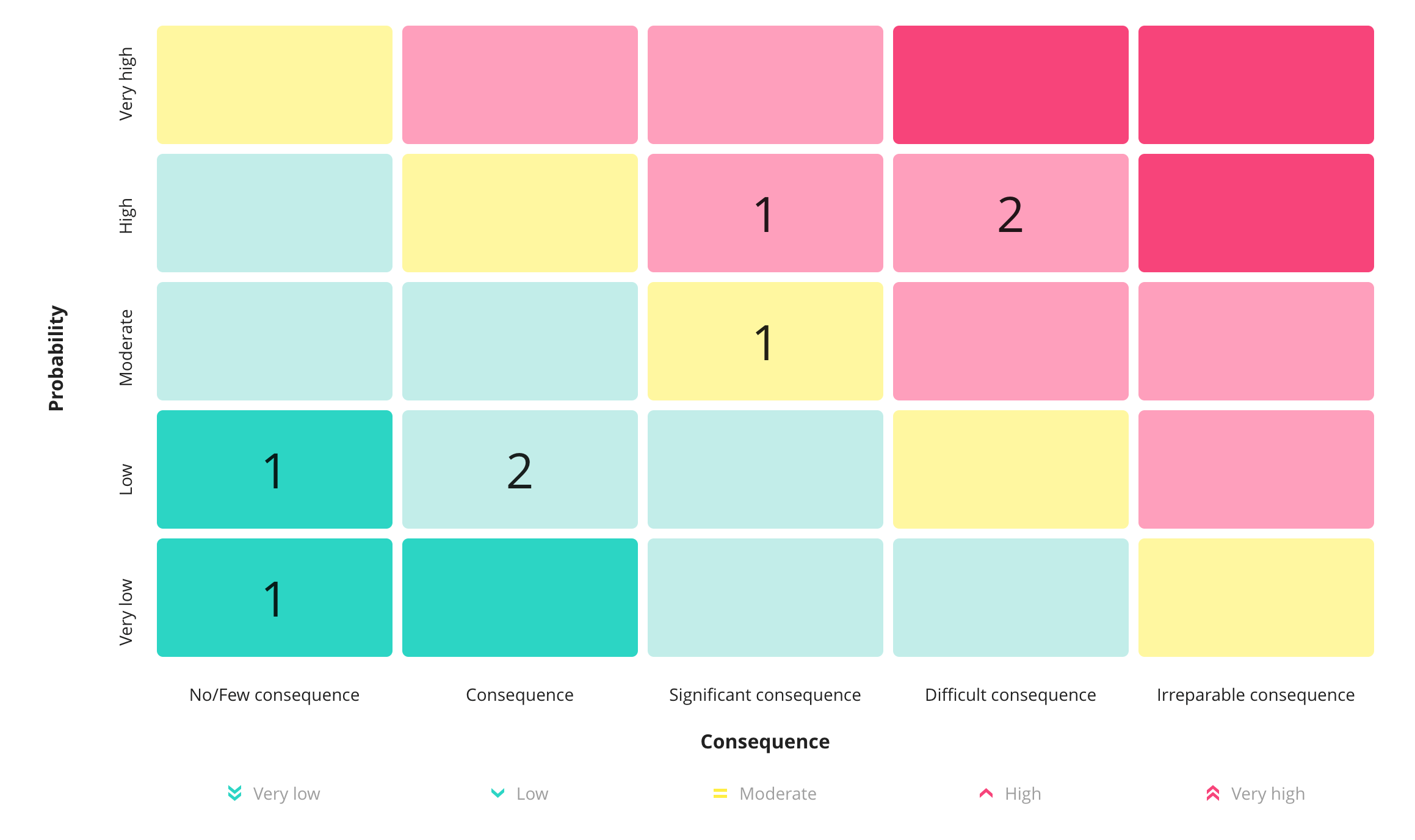

Risk management is a crucial tool in steering your business. Risks can be addressed at many levels – from strategic “Enterprise risk” considerations to specific questions like: “What is the risk associated with processing personal data?” or “What risks are involved in this contract with our supplier?” Risks are often interconnected, such as when a process risk is influenced by the systems used within that process.

To manage risks effectively, you should start with a clear overview of your business. Mapping out processes, systems, and suppliers is essential to identifying potential risks. Next, the organisation must establish a risk profile, which documents how much risk the company is willing to accept. It is also vital to consider what influences this risk tolerance – is it driven by financial incentives, reputation, or operational stability?

Once your risk profile is defined, you can identify the organisation’s threat landscape and decide from which angles you will address risk. For example, your organisation may choose to focus on specific operational parameters or may need to comply with external requirements. If your company processes personal data, risk assessments under GDPR are required. Similarly, if your business falls under NIS2 regulations concerning cybersecurity, you must manage risks related to critical operational processes.

The foundational risk model is often established at the management level. However, spotting and handling real risks on an ongoing basis requires defining a risk assessment method and embedding it within the organisation. Effective risk management involves engaging the entire company and setting clear processes and procedures for handling risk. Consider the following:

-

Identifying decision-makers (risk owners) and defining their mandate.

-

Identifying key stakeholders and contributors to risk management.

-

Establishing and documenting roles and responsibilities.

It is also crucial to ensure that decision-making processes are not delayed by bottlenecks. Quick action may be necessary to address identified risks effectively.

Resources and Reporting:

When risks are identified, addressing them often requires allocating resources to mitigate the risk, such as implementing improved measures. These decisions are typically made at the management level, where factors such as financial implications and consequences are weighed. To ensure risks transition from risk owners to management, establishing effective risk reporting is essential.

You can find a specific example on how to make a GDPR risk assessment here.

What Does Compliance Mean?

Compliance, directly translated as "adherence to rules and compliance with guidelines," is a central process for any business. It ensures that the company complies with relevant legislation, standards, and internal policies. Although the term may sound like a buzzword, it is an essential part of business operations and integrity. This is why compliance should be a core part of your company’s strategy – and the earlier it is integrated, the easier it will be to maintain compliance over time.

At its core, compliance is about keeping the company in line with the laws and regulations relevant to its activities. This is not just about avoiding fines and sanctions but also about building trust among employees, customers, and other stakeholders. Compliance is therefore not a static state but a dynamic process, requiring your organisation to continuously adapt its documentation and practices to changing legislation and circumstances.

How do you achieve compliance?

It starts with identifying the laws, regulations, and standards relevant to your business. This will depend on your industry and geographical location. The company should then establish clear internal guidelines and procedures that ensure adherence to these requirements. For example, this might involve:

-

Mapping relevant laws and regulations, such as GDPR, NIS2, or industry standards.

-

Implementing internal policies and controls to ensure compliance.

-

Continuously monitoring and evaluating processes to ensure ongoing adherence.

-

Training employees to understand and follow compliance requirements through awareness training.

Compliance is often anchored in the company’s leadership, but the entire organisation must contribute to creating a culture where compliance is seen not as a burden but as an essential part of business operations.

Benefits of compliance:

An effective compliance strategy enables you to:

-

Reduce legal and financial risks.

-

Improve the company’s reputation.

-

Ensure transparency and trust among employees, customers, and stakeholders.

By taking compliance seriously, your business can not only minimise risks but also strengthen its market position and foster a healthy and robust business culture.

Why are Governance, Risk, and Compliance Important?

Why is Governance, Risk, and Compliance important?

Governance, Risk, and Compliance (GRC) form an integrated framework that helps businesses navigate a complex and often regulated landscape. These three elements complement each other and provide a holistic approach to business management and risk handling.

Governance: Lays the foundation for how the company is managed and led. Governance ensures clear structures, roles, and guidelines that promote accountability and transparency.

Risk: Helps identify and manage potential threats to the company’s operations. These threats can range from operational risks to cybersecurity threats.

Compliance: Ensures that the company adheres to laws, regulations, and standards, protecting against legal and financial sanctions.

The connection between GRC: When governance, risk, and compliance are closely linked, they create a solid framework for ensuring both stability and flexibility within the business. For example, governance structures can support better risk management, and compliance can serve as a benchmark for how effectively governance and risk processes are functioning.

| Example: GRC in practice Imagine a company specialising in IT consultancy and development. Governance ensures there are clear policies for handling and protecting data. Risk management identifies potential threats such as cyberattacks or data breaches and evaluates how to mitigate them. Compliance ensures the company meets standards such as ISO 27001 and other relevant regulations. Together, GRC ensures that the company not only meets requirements but also builds trust with customers and partners. |

What is Governance, Risk, and Compliance (GRC) software? And should you use it?

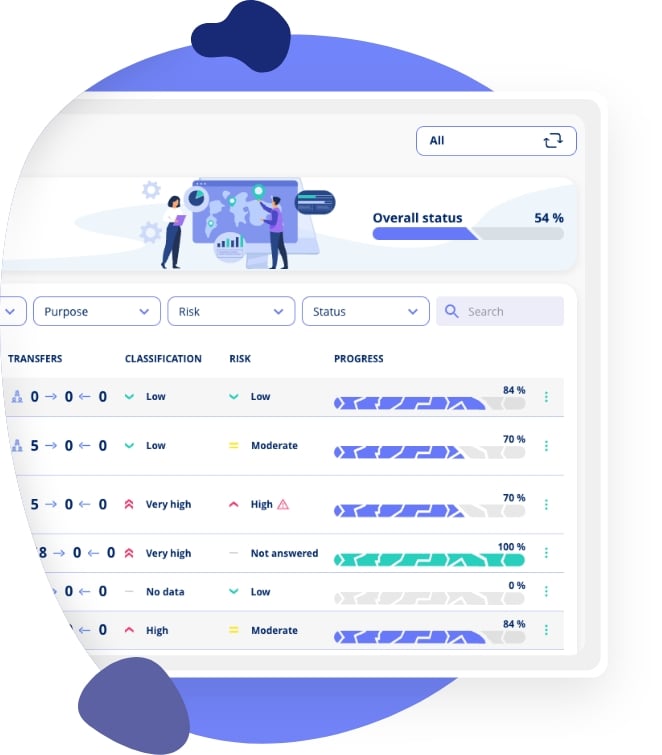

Governance, Risk, and Compliance (GRC) software is designed to consolidate and automate processes within governance, risk management, and compliance. It provides businesses with a central platform to manage and monitor activities, ensuring an effective and consistent approach to GRC.

Key features of GRC software:

-

Governance: Helps define policies, roles, and responsibilities and monitor their implementation. This can be configured so that each user on the platform has a role, granting access to different parts of the system and data.

-

Risk Management: Identifies and analyses risks, providing management with a clear overview and enabling informed decision-making. GRC software can help establish an accessible framework that employees across the organisation can use.

-

Compliance: Monitors adherence to legislation and standards and generates reports that can be presented to authorities or stakeholders. Additionally, the software can help keep your documentation aligned with current laws, even as they change.

Benefits of GRC software:

-

Automates manual processes and saves time.

-

Improves data security and reporting.

-

Provides a consolidated view of the organisation’s governance, risks, and compliance.

Should your business use GRC software?

If your business operates in a regulated industry, has complex operations, or seeks to streamline GRC processes, software can be a significant advantage. It allows you to centralise information and ensure a consistent approach to risk management and compliance. For smaller businesses, dedicated software might seem unnecessary, but it can still be a worthwhile investment that reduces errors and saves resources in the long term.

Use our article: Do I really need compliance software? To determine if GRC-software is something you should look into.

Conclusion

Governance, Risk, and Compliance are not just buzzwords but fundamental building blocks for any company’s success. By understanding and working with these concepts, you can strengthen your company’s resilience, reduce risks, and build a solid foundation for future growth. Consider how your business can benefit from GRC software and foster a culture where governance, risk, and compliance work hand in hand.

GDPR Compliance Software

.jpg)

.jpeg)

.jpg)

.jpg)

.jpg)

-1.png)

.jpeg)

.jpg)

Info

.legal A/S

hello@dotlegal.com

+45 7027 0127

VAT-no: DK40888888

Support

support@dotlegal.com

+45 7027 0127

Need help?

Let me help you get started

+45 7027 0127 and I'll get you started

.legal is not a law firm and is therefore not under the supervision of the Bar Council.